Levy Relief Strategy

Each year, Norfolk County staff present Council with a draft budget for consideration.

This year’s $220M budget (approximately $105M of which is funded through taxes) includes $3.2M in cost-cutting measures and operational efficiencies.

It also includes a proposed plan to temporarily borrow $5M from the Legacy Fund to provide relief to local taxpayers already struggling from the effects of COVID-19 on the economy (Levy Relief Strategy).

Background Because much of this year’s operating budget is devoted to COVID-19, as well as critical infrastructure and set costs such as wages defined by collective bargaining agreements, insurance, contractual obligations, debt payments and utilities, a 2021 budget with no new spending would have required a 12 percent increase on the tax levy. With the $3.2M in cost-cutting measures, as well as the proposed $5M loan from the Legacy Fund, the increase to the levy would instead be reduced to 3.8 percent. Council is looking for public input as to whether to proceed with borrowing from the Legacy Fund to offset the increase to the tax levy.

What is the Levy Relief Strategy? Even after the inclusion of cost-cutting measures, the net levy requirement would still represent a significant increase for the average residential tax payer. When considering the prior year tax increases, as well as the current economic situation, this increase would be difficult for many residents and businesses. To reduce the current year burden on taxpayers, the levy relief strategy has been presented as a temporary plan. This strategy provides revenue over the next 2 years in order to reduce the tax levy, with a long term plan to pay back the funds utilized to reduce the taxation pressure in the current year. The plan would implement a levy stabilization loan from the Legacy Fund, in the amount of $5.0M for 2021 to protect required investments included in the levy budget (specifically, infrastructure funding). The loan would be repayable by the Levy, with a 2-year interest free period, followed by a 10-year amortization, at a 3.7% interest rate. For 2022, staff are projecting a net levy requirement increase of 8.4%. This is driven by underlying expense increases to support operations and increased infrastructure funding, offset by a placeholder for potential savings initiatives. A further stabilization loan of $2.5M is likely to be required to ease tax-payer burdens for 2022, aiding in the phasing-in of the one-time revenue impact from not having stabilization funds. This will bring the total stabilization loan taken from the Legacy fund to $7.5M, and add a further commitment of approximately $0.3M (+0.2% levy impact) to taxpayers from 2024-2033 to repay this loan. It should be noted that this strategy will not result in sustained reductions, which is the fundamental difference between this strategy and the result of the cost-cutting options. This is a temporary measure that uses a one-time source of funds to reduce the current year’s taxation to “buy time” in order to identify the savings and service level changes to reduce the net levy requirement for the long term. There are two extremely important facts that the Budget Committee and public need to be aware of if this proposed strategy is endorsed.

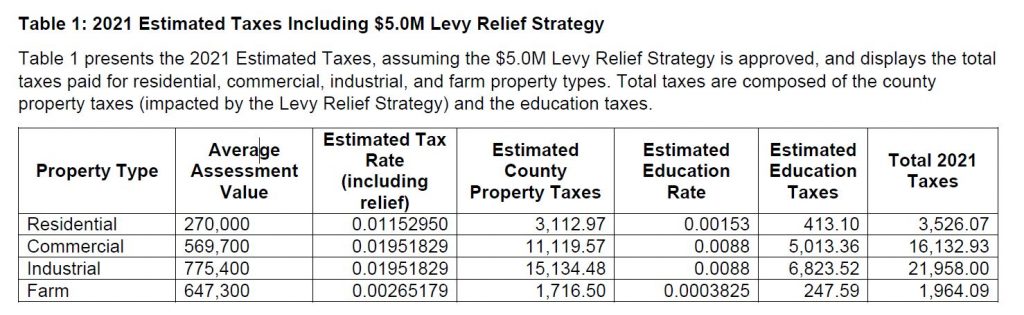

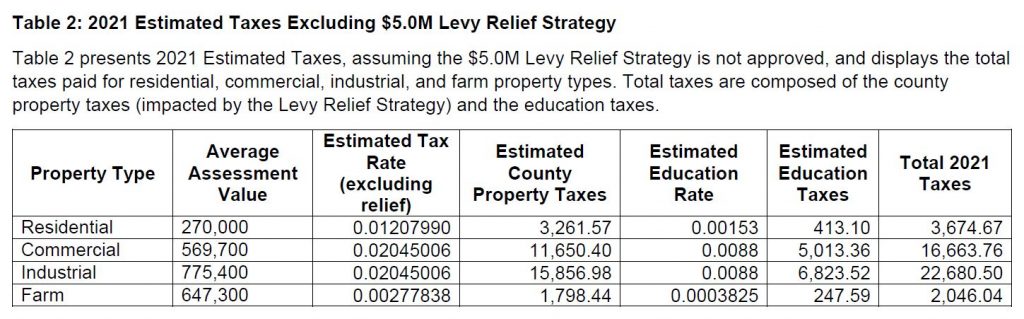

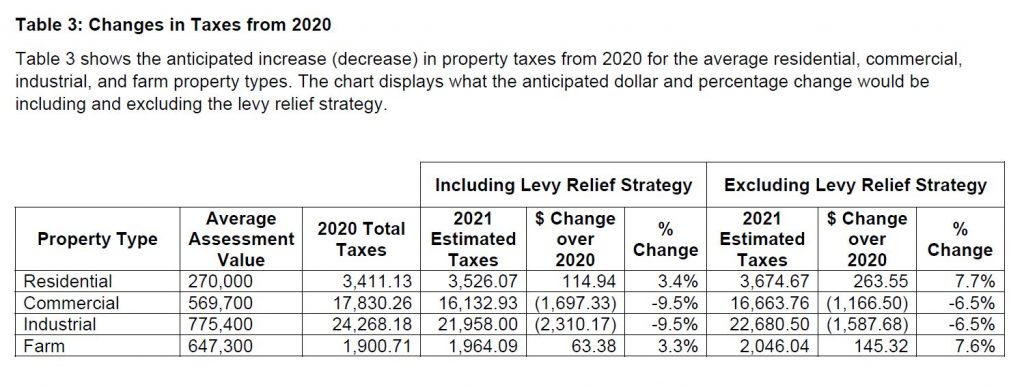

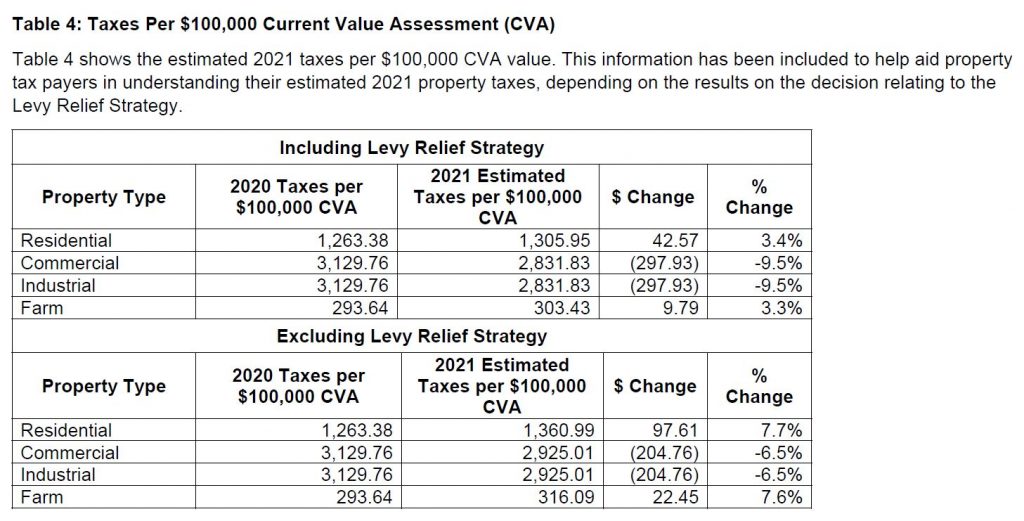

Impact on taxpayers Using the Levy Relief Strategy vs. not using Levy Relief Strategy Within these tables, the average assessment for each property class has been utilized. This was completed based on the request from Council at the January 26th meeting. Therefore, you will notice the residential average assessment is higher than the residential median assessment which was used in discussion of the tax impacts in prior Budget Committee meetings. If Council proceeds with the Levy Relief Strategy, 2021 taxes will be lower; this scenario has been presented in Table 1. If Council does not proceed with the Levy Relief Strategy, 2021 taxes will be higher; this scenario has been presented in Table 2. Changes in taxes from 2020 Total property taxes are made up of two components: county property taxes and education taxes. When Norfolk County Council is setting the annual budget, this impacts the county portion of property taxes. Education rates are set by the province. The total change in property taxes over 2020 has been presented in Table 3 utilizing the average assessment values and property types, consistent with Tables 1 & 2. The annual dollar impact and % change has been displayed for each class. It should be noted that commercial and industrial property types are anticipated to see a reduction in total taxes in 2021 as compared to 2020. This is due to changes in the business education rates, which is explained further below. Education Rate Information The Ministry of Finance has recently announced estimates for the 2021 education tax rates as follows: Residential Education Tax Rates – The residential education tax rate for 2021 is 0.153%. This rate remains unchanged from the 2020 rate as property assessments for the 2021 taxation year will continue to be based on the same valuation date that was in effect for the 2020 taxation year. This is the rate that has been included throughout tax calculations during budget deliberations. Business Education Tax Rates – Business education tax (BET) rates will be reduced to 0.88% in 2021. This will benefit over 200,000 business properties across 95 per cent of all municipalities and will create over $450 million in annual savings for businesses. Calculating property taxes Table 4 provides total estimated taxes per $100,000 Current Value Assessment (CVA). By reviewing the assessed value on the most recent tax bill (2020) or MPAC assessment notice, and utilizing the table, property owners can calculate their estimated tax increase. Illustrative Example A residential property owner who has a home with a current value assessment of $400,000 would calculate their 2021 anticipated taxes including Levy Relief as follows: 1. Calculate your CVA multiple by dividing your assessed value by $100,000. 2. Calculate your estimated taxes by multiplying your CVA multiple by the corresponding Property Type value presented in Table 4. Estimated Taxes = CVA Multiple x 2021 Est. Taxes per $100,000 CVA Including Levy Relief

CVA Multiple = $400,000 property value / $100,000

CVA Multiple = 4

Estimated Taxes = 4 x $1,305.95

Estimated Taxes = $5,223.80

Have your say Members of the public can use this form to provide feedback to Council. All submissions will be shared with Council for information purposes.

Frequently Asked Questions When will the budget be officially passed? The Budget Committee passed the budget on January 19, but the budget requires formal approval at a Council meeting. Council met January 26 to consider the budget and deferred their decision to Feb. 2, in order to allow further public input on the Levy Relief Strategy. If there was no new spending included in this budget, would an increase in taxes still be necessary? Because much of this year’s operating budget is devoted to COVID-19, as well as critical infrastructure and set costs such as wages defined by collective bargaining agreements, insurance, contractual obligations, debt payments and utilities, a 2021 budget with no new spending would have required a 12 percent increase on the tax levy. What are some of the cost-saving measures included in this budget? Staff proposed nearly 30 cost-cutting options and efficiencies for the budget committee’s consideration. Some of the cost-cutting measures approved by the budget committee include: Will further cost-saving measures be considered for future budgets? Yes. Staff will form a committee to explore further options in advance of next year’s budget deliberations. Regular updates will be provided to Council throughout 2021. Why is my property assessment value different from current market values? The Municipal Property Assessment Corporation (MPAC) conducts a province-wide assessment update every four years. The last update was conducted in 2016 with a valuation date of January 1, 2016. If the value of the property increased from the previous update in 2012, the increase was phased-in over four years from 2017-2020. Due to the COVID-19 pandemic, the Ontario government postponed the 2020 assessment update. Therefore, the property assessments for the 2021 tax year will continue to be based on the fully phased-in January 1, 2016 current values. The property assessment value from MPAC is utilized when determining property taxation. Property owners should refer to their most recent tax bill (2020) or MPAC assessment notice for their current assessment value. The assessment value from MPAC differs from current market values.